Are you an employer overwhelmed by trying to understand the W-2 form? Are you a new hire that has never seen one before but needs to complete their taxes? Do you need help understanding how hospitals, universities, and other organizations use the W-2 form correctly?

If so, then this blog post is for you! This comprehensive guide will explain all the basics of filling out a W-2 form and provide helpful resources for employers needing more assistance. You can be sure your taxes are properly handled by educating yourself on the different parts of a W-2 form—such as what it means and how it’s used. Let's get started on our Complete Guide to the W-2 Form today!

What is a W-2 Form, and why do you need to file one each year

A W-2 form is an important document that employers must provide to their employees. It states the wages and other compensation earned throughout the year and any taxes withheld from those wages. This information is used by both the employee and the Internal Revenue Service (IRS) when filing income taxes at the end of each year.

The W-2 form also details other benefits from your employer, such as health insurance premiums, 401(k) contributions, flexible spending accounts, or other payments not included in your regular paycheck or salary. These amounts are then reported on your tax return so that you can accurately determine your total taxable income for the year.

Not only do employees need to file a W-2 form each year to accurately report their income and other benefits for tax purposes, but employers also must provide this document. The IRS requires any employer that pays wages of $600 or more in a given year to issue a W-2 form to all its employees. This ensures accuracy in the filing process and helps ensure everyone pays the correct taxes.

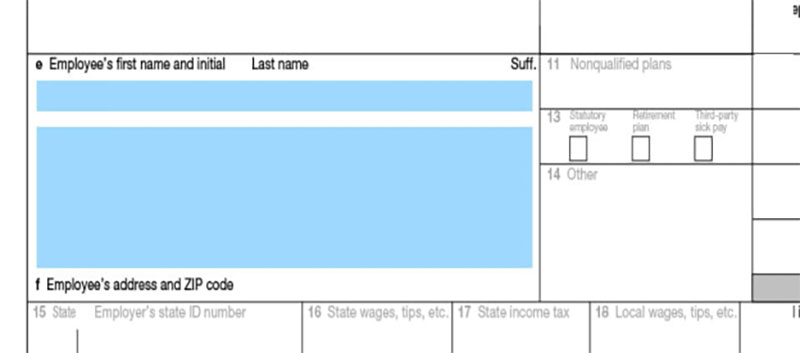

Lettered Fields (a-f)

The lettered items on the W-2 form provide even more detail about specific aspects of your wages and taxes withheld. These include:

A) The employee’s full name and Social Security number

This is necessary to accurately report wages and taxes withheld.

B) Employer’s name, address, and Federal Identification Number (FEIN)

These are all important for the IRS’s records of your employer.

C) Wages paid

This includes regular wages, bonuses, or other special payments in Box 1 of the form.

D) Taxes withheld

This includes state income tax, Federal Income Tax, FICA contributions such as Social Security and Medicare taxes, and any additional amounts deducted from your paychecks throughout the year.

E) Other amounts not subject to withholding

This can include 401(k) contributions or other benefit payments made by your employer on your behalf that are taxable but

Numerical Fields (1-20)

The numerical items on the W-2 form provide even more detail about specific aspects of your wages and taxes withheld. These include:

1) Box 1 - Wages, tips, other compensation

This box shows the total wages, salary, bonuses, commissions, and other taxable income earned during the calendar year.

2) Box 2 - Withheld Federal Income Tax

This box shows any federal withholding taxes from your paycheck throughout the year.

3) Box 3 - Social Security wages

This box details the wages subject to Social Security tax during the year.

4) Box 4 - Social Security tax withheld

This box shows how much was withheld for Social Security taxes from your paycheck.

5) Box 5 - Medicare wages and tips

This box shows the amount of wages and tips that are subject to Medicare taxes during the year.

6) Box 6 – Medicare tax withheld

This box shows how much was withheld for Medicare taxes from your paycheck.

7) Boxes 7-20 – Other information

These boxes may show additional information related to other benefits such as health insurance premiums, 401(k) contributions, flexible spending accounts, etc. Important information must be reported on your tax return for accuracy.

8) Boxes 21-25 – State/local tax information

These boxes include details about state and local income taxes that were withheld from your paycheck.

9) Box 26 – State wages, tips, and other compensation

This box shows the total wages, salary, bonuses, commissions, and other taxable income earned during the calendar year for state tax purposes.

10) Box 27 – State income tax withheld

This box shows any state withholding taxes from your paycheck throughout the year.

11) Box 28 – Local wages, tips, and other compensation

This box shows the total wages, salary, bonuses, commissions, and other taxable income earned during the calendar year for local tax purposes.

12) Box 29 – Local income tax withheld

This box shows any local withholding taxes from your paycheck throughout the year.

13) Boxes 30-34 – Other information

These boxes may include details about contributions to a deferred compensation plan or other benefits you received that need to be reported on your tax return. These must also be included when completing state/local taxes correctly.

By understanding the different parts of a W-2 form, you can ensure your taxes are accurate and complete. Knowing what to expect from your employer on a W-2 form will save you time and ensure you report your income and deductions correctly. In addition, employers should also understand their responsibilities when it comes to accurately filing these forms.

How to access and fill out the form correctly

Understanding how to correctly access and fill out a W-2 form can be confusing. Fortunately, plenty of resources available online can help with this process. Many employers offer online forms that employees can use to submit their information, or they may require the official IRS form to be filled out by hand. Additionally, most employers provide an easy-to-use guide for filling out the form, making understanding each section easier.

When filling out a W-2 form, it’s important to be extremely accurate. Even small mistakes can delay the process or result in an incorrect tax return. Make sure that all of the information is written clearly and correctly, especially when it comes to Box 1, which states the wages earned, and Box 2, which states the amount of federal income taxes withheld from each paycheck.

FAQs

Q: Who needs to fill out a W-2 form?

A: The employer must provide each employee with a W-2 form by January 31st of each year. Employees should then complete their taxes using this information. Hospitals, universities, and other organizations may also need to file forms related to the W-2 for reporting purposes.

Q: What information does a W-2 contain?

A: The W-2 form contains several key pieces of information, including the employee’s name and Social Security number, wages earned during the year, taxes withheld from their paycheck, employer address, contact information, Medicare wages, and tips reported by the employee.

Q: How do I fill out a W-2 form?

A: To complete a W-2 form, employers must provide accurate information about each employee’s wages. Additionally, they must calculate the appropriate amount of taxes to withhold from each employee’s paycheck based on their current marital status and any deductions or credits allowed for that tax year. Employers must also ensure that all forms are filed correctly with the IRS to comply with regulations.

Conclusion

With this comprehensive guide, you can better understand how to fill out and use the W-2 form. Though it can initially seem complicated, having an accurate understanding of the different parts of a W-2 form is critical for employers and employees to accurately complete their taxes each year. Plenty of online resources are available if you need additional help or resources for filing your W-2 forms properly. With these tips, filling out a W-2 form should be easier than ever!