Are you the beneficiary of an Inherited IRA? Chances are you have questions about managing your inheritance—such as the rules and regulations around Inherited IRAs and how they can be best utilized.

Well, look no further! In this blog post, we’ll cover the ins and outs of Inherited IRAs in detail so that you can understand exactly what is involved in managing an IRA left to you by a loved one or friend. So whether you're barely starting with financial planning or need a refresher on retirement accounts, read on for all the information needed to get up-to-speed with this important topic.

What is an inherited IRA?

An inherited IRA is an Individual Retirement Account (IRA) passed down to a beneficiary upon the original account holder's death. If you are named as a beneficiary of an IRA, you can keep it as your own or transfer it into another retirement account. It’s important to note that Inherited IRAs have different rules than regular IRAs regarding eligibility, contribution limits, and tax benefits.

When someone passes away and leaves a Traditional IRA behind, the beneficiary will take over control of the funds. The same applies to Roth IRAs as well. Depending on your relationship with the original account holder, you can take ownership of the Inherited IRA or roll it over into a different account.

How an Inherited IRA works

Beneficiaries can transfer the money from the Inherited IRA into their account. The transfer must be done within 60 days; any contributions from this money will count toward your annual contribution limit. In addition, beneficiaries can also opt to keep the inherited IRA as is and continue contributing to it up to the annual limits set by law.

When taking ownership of an inherited IRA, you must remember that certain tax consequences are involved with this retirement account. The money contributed to an Inherited IRA may not be taxed immediately like other IRAs, but rather when distributions are taken from it. Beneficiaries may also face early withdrawal penalties if they withdraw money before retirement.

The different types of Inherited IRAs

Spousal Inherited IRA

A Spousal Inherited IRA allows the surviving spouse to control the deceased’s IRA and treat it as their own.

Non-Spouse Beneficiary IRA

If you are not a spouse, you can either roll over the funds into a beneficiary IRA or keep the account with its existing designation.

Stretch IRA

With a stretch IRA, beneficiaries can spread out distributions over their lifetime, allowing them to defer taxes on withdrawals until much later.

Child Inherited IRA

The rules for child-inherited IRAs vary based on the child's age but generally allow parents and guardians to manage an inherited account for minors under 18.

Charitable Inherited IRA

A charitable inherited IRA allows the beneficiary to donate the funds to a qualifying charity or non-profit organization to receive a tax benefit.

Inherited IRA rules: 7 key things to know

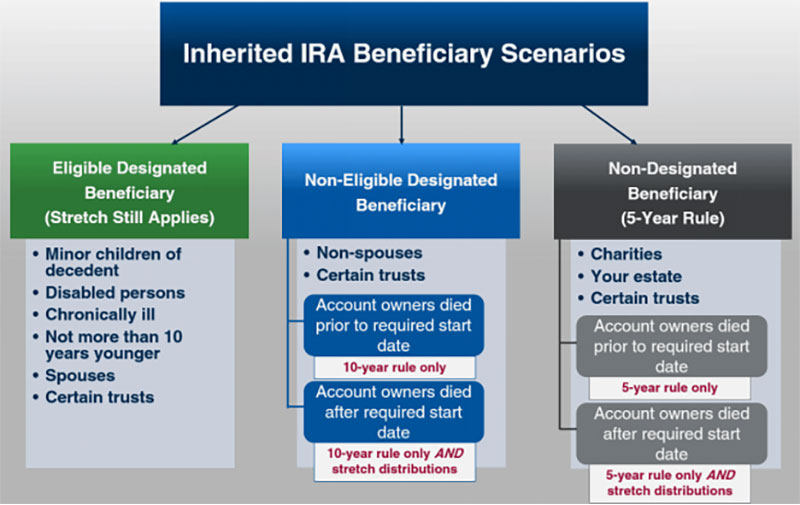

Spouses get the most leeway

Spouses are the only ones who can treat the inherited IRA as their own

It would help if you took distributions: Beneficiaries must start taking required minimum distributions by December 31st of the year after inheriting.

Contribution limits apply

Contribution limits are lower for an Inherited IRA than a regular IRA.

No early withdrawal penalty

An Inherited IRA is exempt from early withdrawal penalties, so beneficiaries can withdraw money without incurring additional fees or taxes.

Tax implications

Contributions to an Inherited IRA are not tax deductible, but withdrawals may be subject to taxation. Taxes may be owed when distributions are taken out depending on the type of Inherited IRA.

For example, with a Traditional Inherited IRA, all withdrawals are generally subject to income tax. With a Roth Inherited IRA, any earnings you take out would normally be taxed at your ordinary income tax rate, while qualified distributions from the principal contributions may not be taxable.

Be aware of the deadlines.

Beneficiaries must take required minimum distributions and complete transfers within certain timeframes or face penalties or taxes. If you inherited an IRA, knowing the deadlines associated with taking distributions and transferring funds is important.

The deadline for taking required minimum distributions depended on the original owner's age when they passed away. Distributions from a traditional IRA must begin by December 31st of the year following the account holder’s death. For Roth IRAs, distributions must begin within five years of the original owner’s death.

Don’t ignore beneficiary forms.

When you set up an Individual Retirement Account (IRA), it is important to consider what will happen to your account after you pass away. One of the best ways to ensure your wishes are followed is by filling out and updating beneficiary forms. This form designates who will receive the funds from your IRA when you pass away.

It is important to remember that beneficiary forms take precedence over any other documents, such as wills or trusts. So, even if you have specified a different person in those documents, they may only be honored if you update the beneficiary designation on your IRA. It’s also important to remember that beneficiary forms can only designate one main recipient and then name contingent beneficiaries as backups if the primary beneficiary has also passed away.

If you plan to leave your IRA to a trust, it is important to ensure that the trust is named as the beneficiary on your IRA form, not an individual or other entity. This will help ensure the funds are properly transferred into the trust according to your wishes. It’s also wise to update these forms regularly throughout your lifetime in case of any changes made to the account, such as marriage or divorce.

Tips for Maximizing the Value of an Inherited IRA

- Understand the rules and restrictions associated with an Inherited IRA.

- Take required minimum distributions within the designated timeframe to avoid penalties and taxes.

- Consider using a stretch IRA or charitable inherited IRA for greater tax benefits.

- Ensure that beneficiary forms are updated regularly throughout your lifetime in case of any changes made to the account, such as marriage or divorce.

- If you leave funds to a trust, ensure it is named as the beneficiary on your IRA form, not an individual or other entity.

FAQs

Q: Who is eligible to open an IRA?

A: To open an Individual Retirement Account (IRA), you must have earned or received alimony during the taxable year you want to contribute. If you’re under 50, there is also an annual contribution limit of up to $6,000. For those 50 or older, the limit is $7,000.

Q: What are the rules for Inherited IRAs?

A: The rules for an Inherited IRA depend on your relationship with the original account owner. Generally speaking, if you’re a deceased owner's spouse, you can open your own IRA with all the funds in it or roll over all or part of it into your existing IRA. Other beneficiaries must take distribution of all money within 5 years after the original owner's death. It's important to note that certain rules may vary depending on where you live, so speak with a financial advisor before making any decisions.

Q: How is tax paid on an Inherited IRA?

A: Taxes will depend on the type of beneficiary you are. Generally, if you’re a spouse inheriting an IRA, you can treat it as your own, and no taxes are due until withdrawals are taken. Other non-spouse beneficiaries must take distributions from the Inherited IRA and pay taxes at their applicable tax rate.

Conclusion

Inheriting an IRA can be complicated, but it doesn’t have to be. With the right information and a good financial advisor, you can ensure your Inherited IRA is managed properly and used to its fullest potential. With these FAQs as a guide, this blog post has hopefully given you more insight into some of the key aspects of Inherited IRAs so that you can make the best decisions for your future.